Camille A. Hanard

AMA Recap: Acala & Karura

Speaker: Dan Reecer, VP of Growth @ Acala & Karura

Date of the event: May 21, 2021

DeFi Teller

Hello everyone and welcome to our AMA session with the vp of growth for Acala / Karura Dan Reecer!

Hi Dan, we are very happy to have you in our community!

Dan Reecer | Acala & Karura

Hey everyone, thanks for having me.

DeFi Teller

First of all, we would like to ask you to introduce yourself, although, of course, we all know and love your Twitter threads and YouTube videos, where the complex architecture of Polkadot and Kusama is explained in simple and clear language.

And still, could you say a few words about your, I'm sure, extensive professional experience?

Dan Reecer | Acala & Karura

Thanks, glad some of those threads/videos have been helpful! It's definitely a lot of work to understand everything going on in the Polkadot/Kusama world.

I'm working as VP of Growth at Acala & Karura. I came onto the Acala team in the beginning of the year, after having spent 1.5 years at Web3 Foundation working on the Polkadot and Kusama launches. Prior to that I led marketing at wanchain for 1.5 years. Before going full time into blockchain, I spent four years doing pharmaceutical brand marketing for medicines in areas like cancer, alzheimers, and auto-immune.

DeFi Teller

That's impressive! Thanks Dan!

Very soon Kusama, and consequently Karura, will have a number of big and important events. After the announcement of our AMA, we got a lot of questions from our followers, but probably one of the most frequent questions was about the dates, so I'll ask them right away.

Dan, could you please announce the main dates of the upcoming events - the start of the crowd loans, the auction, the auction results announcement and, of course, in case of a positive outcome (and I'm sure it will be so), the launch of Karura?

Dan Reecer | Acala & Karura

Haha, I'm sure! I have the same question about dates as everyone else.

We are all waiting on Gavin and the team at Parity to announce next steps. It could happen at any moment. There is some testing being done on the first "common good" parachain (called Statemine). Once things look good to the Parity dev team, they'll announce the start date of the first parachain auction.

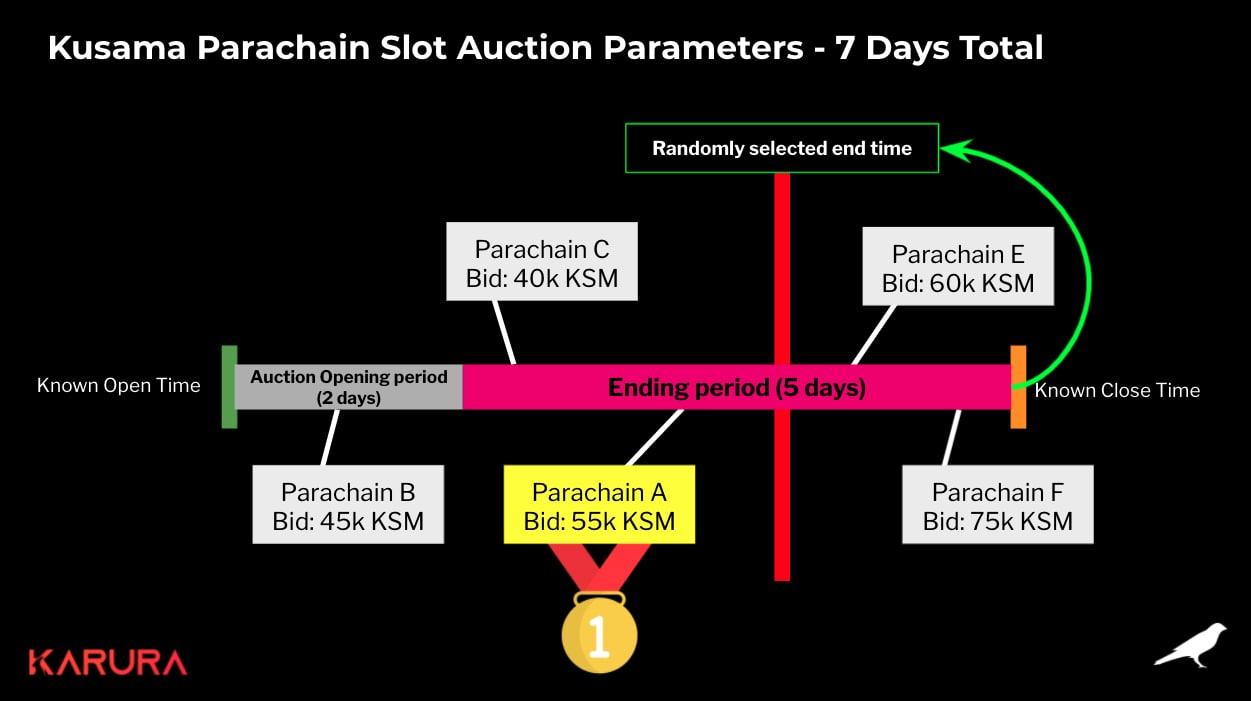

We do know that the auction will be seven days. The first two days will be an "opening period" and the last five days will be the "ending period" which is the period in which the winner will be randomly selected.

So for Karura as a parachain team competing in the auction, our goal is to be winning at all times during the last five days of the auction so that we have 0% chance of losing.

DeFi Teller

That tricky part, when the high bid doesn't give you a win if you make it late enough...

Dan Reecer | Acala & Karura

Exactly. The "candle auction" style incentivizes everyone to bid as high as possible as soon as they can, because you never know at which time the winner will be selected. However, the winner won't be selected until the end at the "known close time" seven days after the start.

DeFi Teller

I suggest we go straight to the questions from our readers. We have divided them into two subtopics - questions about the operational aspects of Acala and Karura, and questions about the upcoming parachain auction. So let's go through them one by one.

DeFi Teller

- Which differences are there between Acala and Karura projects, regarding the fact their code is the same? How do the tokenomics of the ACA and KAR tokens distinguish?

- Do Acala and Karura base on the exact same code? Is this an open-source code?

- Why does Kusama need its own DeFi hub, if it is Polkadot' experimental platform? Why build an identical project there, instead of building one and migrating from Kusama to Polkadot?

Dan Reecer | Acala & Karura

The main differences lie in the mechanics of the DeFi 'primitives' or products on the two platforms. Acala is built to serve the DOT community, so the Acala Dollar (aUSD) will be backed by things like DOT, BTC, ETH, etc. Acala will also offer liquid staking for DOT (LDOT), allowing people to have a liquid form of their staked DOT that they can use in DeFi while their underlying DOT still earns staking returns. Acala will also be held to a very high standard of bank-grade security and stability.

Karura's products are all centered around KSM, since Karura is being built to serve the DeFi demand of the Kusama community. kUSD will be backed by KSM, BTC, ETH, etc. and the liquid staking will be for KSM (LKSM). Karura will most likely have more appetite for risk, so risk ratios could be allowed to be more extreme, we could see more fun/wild collaterals like Doge or other more degen tokens coming to Karura that may never be accepted as collaterals by Acala governance. It will be a DeFi playground.

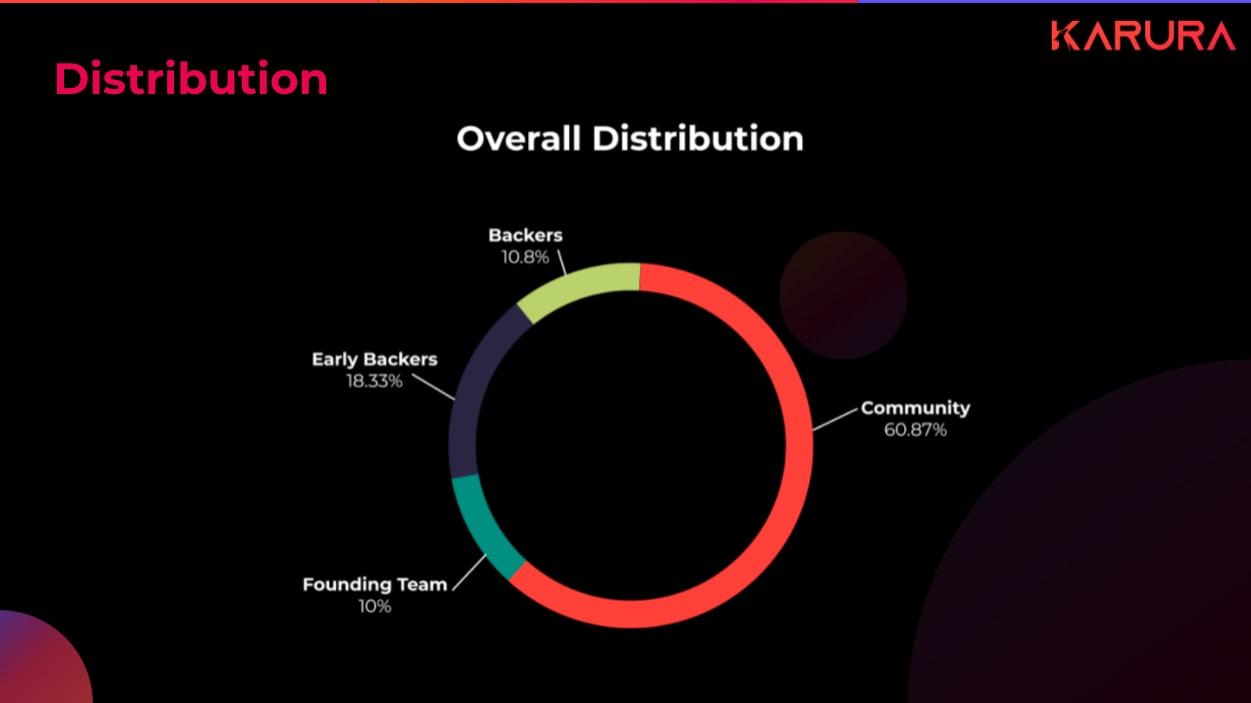

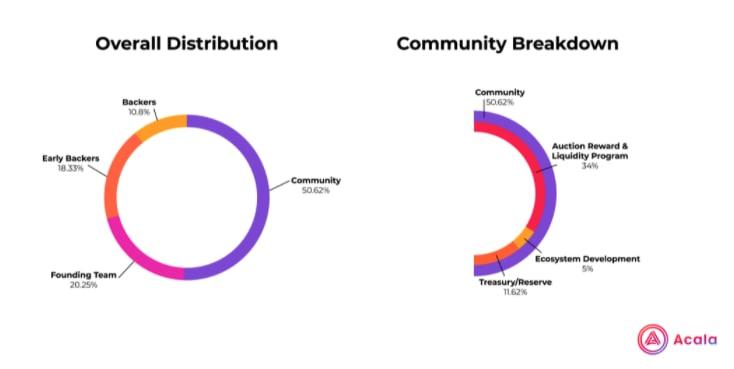

Karura's token distribution is similar to Acala, but we reduce the founding team allocation down to 10% for Karura so that more could go to the community.

Right now the code is the exact same, but could likely begin to change in the future. Yes, Acala's products are all open source, and we have created many products like xcm (cross consensus messaging) that are used by every parachain in the ecosystem. We believe that working together with other teams and sharing code, we'll all make the Polkadot/Kusama ecosystem better.

Here’s our repo.

Kusama today is a $3.2B multi-chain network, the same size as Cosmos, and for context, bigger than Avalanche, Compound, Synthetix, Near. Kusama does serve as an experimental platform for Polkadot, but is also its own multi-chain environment for teams like Karura to build communities and real products. There are even teams like Zeitgeist (started by two of my former coworkers at Web3 Foundation) who are building only on Kusama. Kusama has the exact same benefits as Polkadot, just not quite the bank-grade security that Polkadot has.

With Karura, we understood the huge DeFi demand of all KSM holders, including the need for liquid KSM staking and a stablecoin for the ecosystem. Our goal is to win the first parachain slot on Kusama so that we can provide these open products that can be leveraged by other parachain teams. For example, one of the top DEX parachains is already working with us to integrate the Karura Dollar (kUSD) into their DEX to be ready at launch.

DeFi Teller

How exactly does Karura plan to deliver the DeFi products across Kusama’s ecosystem?

Dan Reecer | Acala & Karura

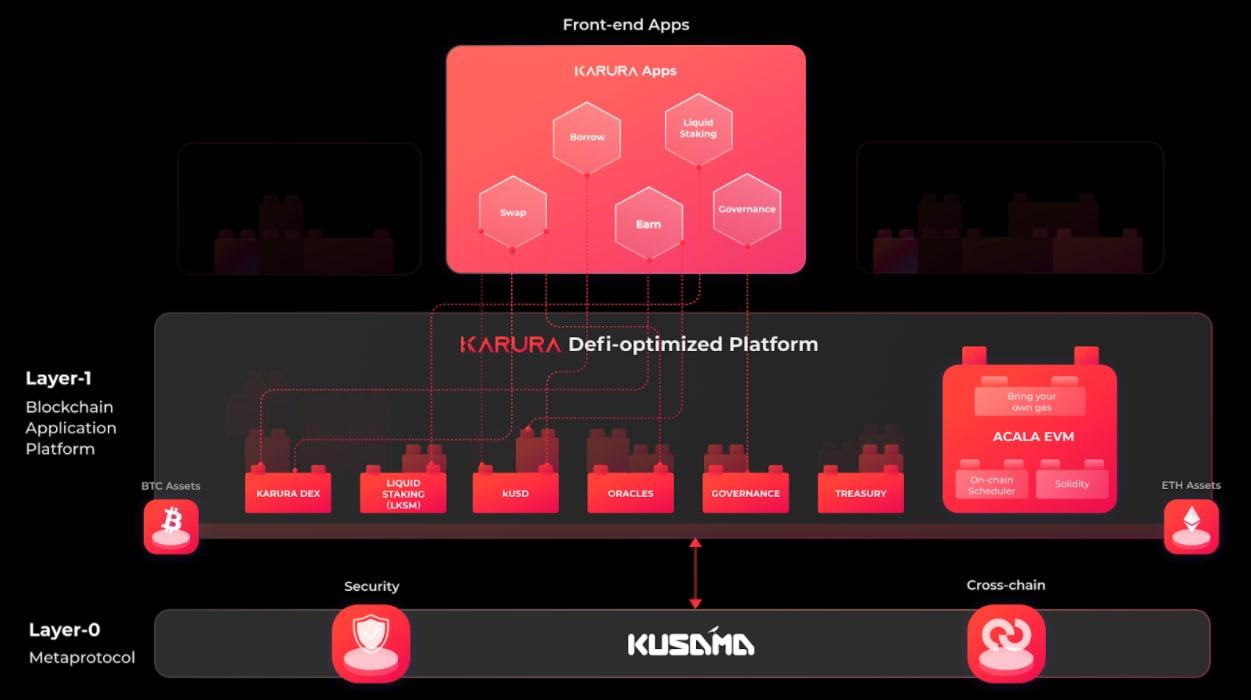

Karura's products are built as 'modules' within the substrate code. Unlike Ethereum, products can actually be built into the blockchain itself with substrate. This makes these substrate modules composable, or usable as legos, with other parachains and apps. For example, a team could build a yield product on top of Karura that leverages the liquid KSM staking primitive in the Karura blockchain. Or you could have another parachain, like a DEX parachain, that uses xcmp (cross-chain message passing) to bring kUSD to their chain to be the standard stablecoin of their DEX.

Here is what I mean by the primitives being built into the blockchain itself, then apps on top being able to leverage those.

And since Karura can upgrade without forks, we will continue to build more and more of these substrate modules into our blockchain, and update seamlessly. Because of this, the amount of innovation that we're about to see in the Kusama/Polkadot ecosystem will be exponential and will really start blowing people's minds.

One thing I'll add too since I posted that diagram. look at the EVM where it says “bring your own gas”. Have you ever run out of ETH or MATIC in your wallet and have to go to an exchange, buy the gas token, send to your wallet, and bridge it to Matic? It's really annoying and inconvenient. With Karura and Acala, we were able to customize our EVM to allow gas fees to be paid in any token. So you can pay gas fees with any token you're holding in your wallet. I cannot wait for this feature.

DeFi Teller

I actually have some questions about fees (of course!), you have already mentioned them, but I'll post them anyway, in case you have something to add.

- What allows Karura to have micro gas fees?

- What fees do Acala and Karura have? Are they expected to grow?

Dan Reecer | Acala & Karura

We're able to have micro gas fees just due to building on Kusama. With Kusama, it was built intelligently in a way that can scale, since Gavin was able to learn from his mistakes when building Ethereum. Gas fees will vary of course, depending on complexity, but for regular transactions we will make them as low as possible. We would actually like to make them free, but we have to have a very small fee to prevent spam attacks on the network.

Fees for regular transactions are expected to be very low, as low at $0.05-$0.40 if I had to guess. Gas fees are not expected to grow over time, but for more complex transactions, the fee will be slightly higher, but never anything close to what we're seeing on Ethereum today.

Another question people ask is "how does this work since gas fees must be paid in KAR".

We built it so that the gas fees paid in any token, BTC for example, gets sent to the Karura DEX on the backend and automatically swapped for KAR at the current market price. Then the transaction is finalized using KAR as the fee on the backend, but the user never needs to see or worry about that part.

DeFi Teller

Okay, thanks! Now smart contracts and DEXes.

- How can one deploy a dApp or smart contract on Karura?

- Which exchanges the Acala/ Karura DEXes will be similar to? How do you plan to compete with other dexes?

Dan Reecer | Acala & Karura

I will answer this a little bit more technically since you're asking a technical question. On Karura (and Acala) there are two ways to build dApps today. 1) Karura Apps: the apps suite we built ourself on top of Karura's chain (you can try at apps.acala.network) are built with pre-compiled contracts that give you access to our substrate primitives through the EVM. 2) the second way to build dApps on Karura and Acala is within the EVM environment using Solidity smart contracts. We have a stealth project being built internally for a yield factory dApp, and this is built using Solidity. This also allows teams like Ampleforth to build on Acala using their EVM/Solidity contracts.

In the future, we will also allow smart contract development on Karura/Acala with the ink! programming language being created by Parity. this is not stable or complete yet, but is Rust-based and will drastically improve the smart contract development experience compared to Solidity.

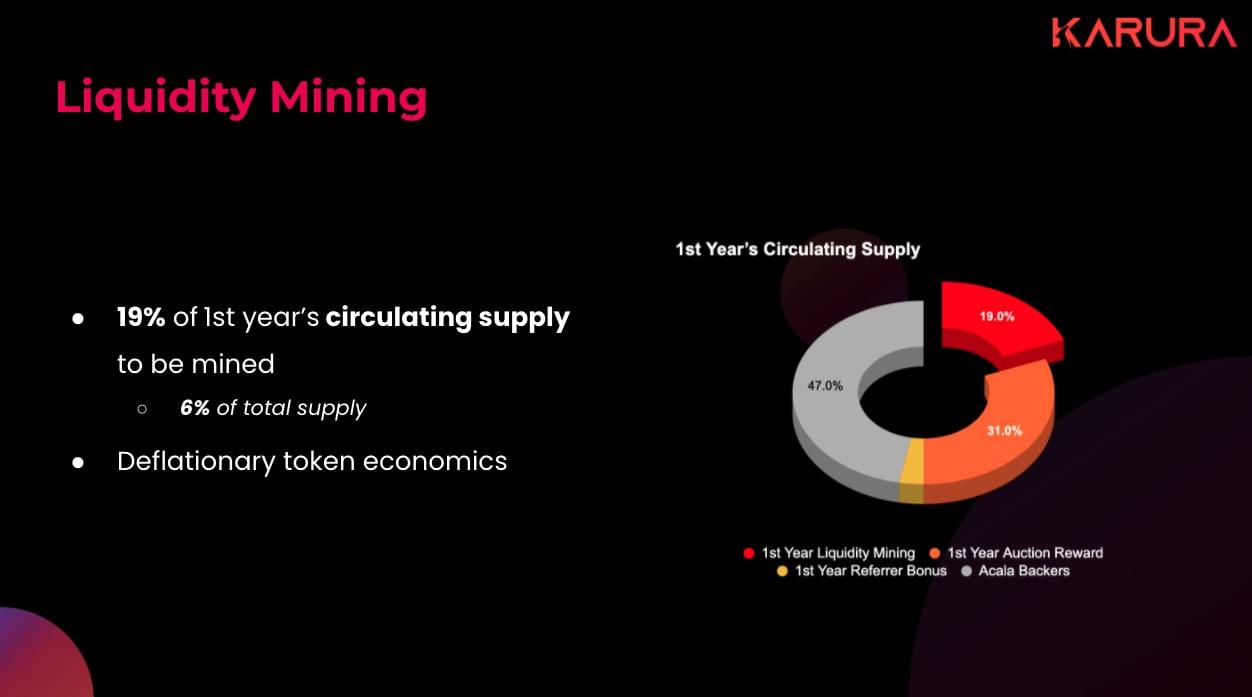

The Acala DEX and Karura DEX are automated market maker DEXs like Uniswap. We plan on bootstrapping our liquidity in many ways, including a liquidity mining program in the first year on both Karura and Acala. For Karura, 19% of the circulating supply in the first year will all come from liquidity mining (keep in mind Karura has a fixed token supply). We will also have bridges to BTC, Ethereum, Compound Chain, and other networks that allow more liquidity to flow to and from our ecosystem. In terms of competition, we don't look at other chains as competition since we are building for multi-chain, but our low fees and 'bring your own gas' will definitely be features that draw new users in.

DeFi Teller

Thank you, Dan! And now let's talk about the stablecoins.

- What use cases for aUSD and kUSD do you see?

- I’ve read that aUSD can be sent to the Laminar chain to be used as a loan by creation of synthetic assets. Could you please explain the way it works?

Dan Reecer | Acala & Karura

As a multi-collateral crypto-backed stablecoins, any use case that DAI has would apply. Use within the DEX, use for borrowing, payments, yield farming, used as a settlement token in lending desks, used by trading desks, etc.

Laminar is our synthetic asset trading platform that will likely launch on Acala, but I have not personally worked much on Laminar so I can't give a good answer to this one. Basically what you'd do to send aUSD to Laminar though, would be to either hold aUSD or collateralize another asset for an aUSD loan, then use the aUSD within the Laminar UI.

DeFi Teller

What derivatives are there on Acala & Karura? Is derivatives related trading important for the platforms?

Dan Reecer | Acala & Karura

At the moment, there are no derivatives on Acala or Karura. Since Acala and Karura are layer-1 blockchain platforms, it's only a matter of time until a team comes and builds a derivatives app.

DeFi Teller

I also have many questions regarding the marketing and the project roadmap piled up. Here are some of them.

- Who are Acala and Karura supported by/ who are they partnered with? Which projects do you plan to cooperate with and what for?

- Marketing is a central element for every project, so that everyone knows the potential that a project can bring is vital to achieve the goals set. What is your strategy to attract new users and investors to your project and keep them long term?

- As far as I know, Acala Network consists of Honzon and Homa protocols. Can you please explain more in detail, what are these two protocols for?

- Can Acala and Karura become each others' potential competitors?

Dan Reecer | Acala & Karura

Acala and Karura's backers include Coinbase Ventures, Polychain, Pantera, Digital Currency Group (owns Grayscale and CoinDesk), Arrington XRP Capital, and many more.

We have integrations with teams like Ampleforth, Injective, and a grant from Compound for our starport we're building between Acala and Compound to bring DOT and LDOT to Compound and bring CASH from Compound to Acala/Polkadot. We also have functioning cross-chain transfers working on testnet with many top Polkadot/Kusama teams like Moonbeam, Plasm, and Phala. We focus on working with top developer teams, and are not worried about pumping out a bunch of empty partnership announcements.

This could be a long answer, but we are focusing on education, community, and product experience for attracting and retaining users. We have launched an ambassador program to grow a base of passionate volunteers who are helping in many different ways, we have a big initiative for education on crowdloans and our products (just hired someone for technical education). On the product side we just hired a new user experience person and will be constantly doing UX design research on the products to improve the experience. The liquidity mining program that I mentioned will also attract users to the platform soon after launch.

We are in the process of changing these names to easier names to remember. You're referring to the Stablecoin protocol and the Liquid Staking protocol. I explained both of these before, but these are the products built into our blockchain that can be leveraged by apps building on Karura or Acala.

No, Acala will help Karura and Karura will help Acala. People used to ask me this all the time about Polkadot and Kusama, and the answer now in reality with both networks being live is clearly no. Kusama and Polkadot help each other, and we're all stronger because of this dual network model.

DeFi Teller

Are there any updates planned for the two projects? What are the key points in the Acala and Karura roadmap?

Dan Reecer | Acala & Karura

The Karura product and governance roadmap is here.

The next steps and goals for us are:

- Host the crowdloan for Karura to begin crowdsourcing KSM that we'll use as our bid in the auction.

- Win the first parachain auction on Kusama and launch Karura.

- Follow the Karura roadmap linked above.

- Host another crowdloan, this time for Acala, raising DOT.

- Win the first parachain auction on Polkadot and launch Acala.

- Begin launching and bootstrapping all Acala apps.

DeFi Teller

Okay, thank you, Dan! Now that we've dealt with the basic questions about Acala & Karura's structure and plans, let's move on to the questions about upcoming crowdloans.

- I don't really understand the math behind the crowd loans process, how can locked DOT or KSM help the parachain team financially? More like a tool to distribute native project tokens. How many ACA and KAR will be distributed in your case?

- How do I prepare for these crowd loans? Can you please elaborate on the staking process? Is there also a time frame like in those candle auctions?

- What are you going to do to win a candle auction slot? What is the expected amount of KSM to be raised and how fast should you act on it?

Dan Reecer | Acala & Karura

Crowdloans are not meant to help the team financially. We have raised funds in previous rounds. The crowdloan is mostly for token distribution (since everyone will receive KAR) and for creating skin in the game for parachain teams. On Ethereum, the ICO scams happened because there was no skin in the game - anyone could launch a token, raise money, and run away without delivering (again, Gavin learning from Ethereum's mistakes). With crowdloans, we are incentivized to deliver value, utility, use cases to the network. In KAR's case, 11% of the supply will be distributed in the first crowdloan at a rate of at least 12 KAR for every 1 KSM, but this could increase depending on participation rates.

You will need to have KSM unstaked. Many people, including myself, are already unstaking to prepare for the start of crowdloans because it will start any day now. Crowdloans will start before the auction, and will run through the whole auction period. So people can contribute before the auction starts, or even during the auction.

The work to win the candle auction has taken place over the course of the last 6 months. We are the only team who has been focusing energy on our Kusama-based network for months, and because of that, we have a large community of Karura supporters. We have no idea how much KSM will be in our final bid - it's like asking how much will be the winning bid for the local auction for a house...you just have to see what the market determines. I do expect the first few auctions will have much higher KSM value than later auctions once the demand begins to decline a bit. All I know is that the auctions are going to be incredibly exciting and I can't wait for them to start. Crypto sports!

DeFi Teller

And the last one about the parachain lease.

What should be done when the parachain lease expires? As I understand, you need to auction again or lease a parathread - but does this really have to happen all the time during the lifespan of the project? How many months or years can Karura's independent treasury handle?

Dan Reecer | Acala & Karura

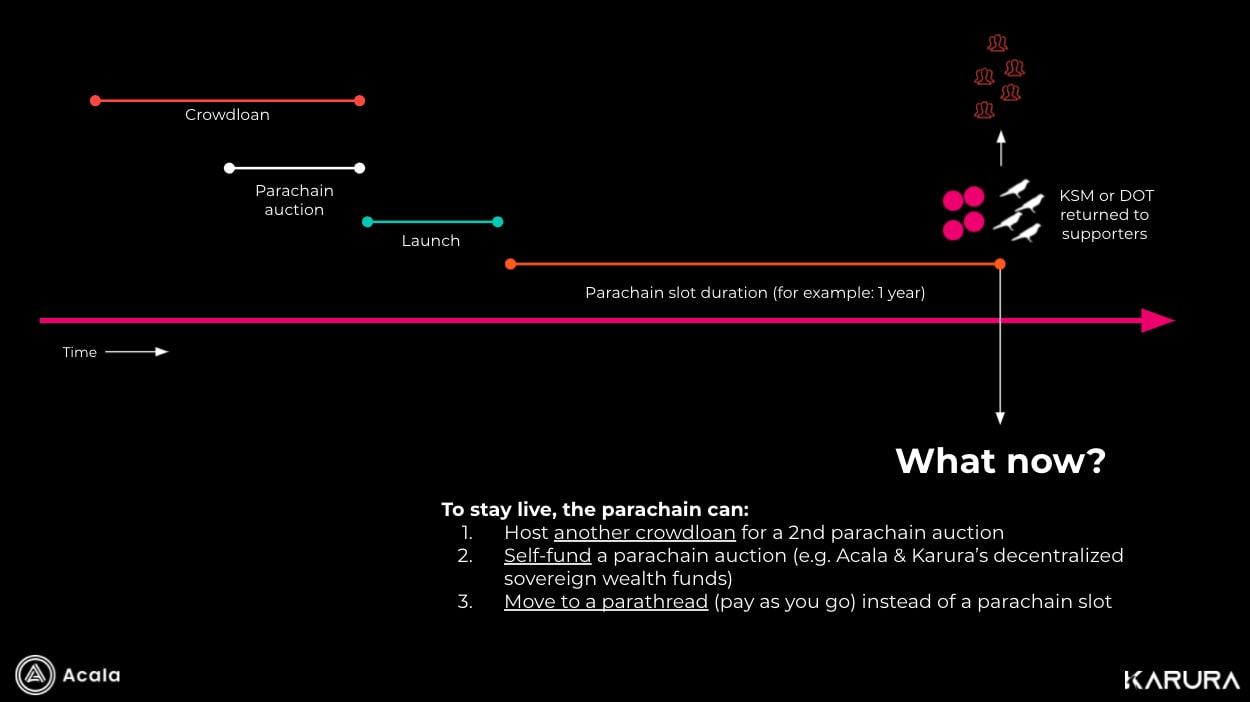

Yes, as a parachain on Kusama we'll have to renew our lease every 48 weeks. On Polkadot, we'll need to renew every two years.

Karura and Acala will both have a decentralized sovereign wealth fund (dSWF) which will build up overtime through revenue generated from the protocol. This is an on-chain treasury owned and managed by the token holder. Our goal is to build up both of the dSWF so that we can self-fund future parachain slots instead of having to do another crowdloan.

If a team does not renew their slot lease, they can either shut down their chain or move to a "parathread". A parathread is the exact same as a parachain, but it is just a "pay as you go" model for putting information into a block. Parathreads will pay whenever they need to inject data into the blockchain, versus parachains which have constant access to the relay chain.

DeFi Teller

What will happen if I stake my KSM and support a team that doesn't win in the end? What will happen to my KSM, will they be returned to me immediately?

Dan Reecer | Acala & Karura

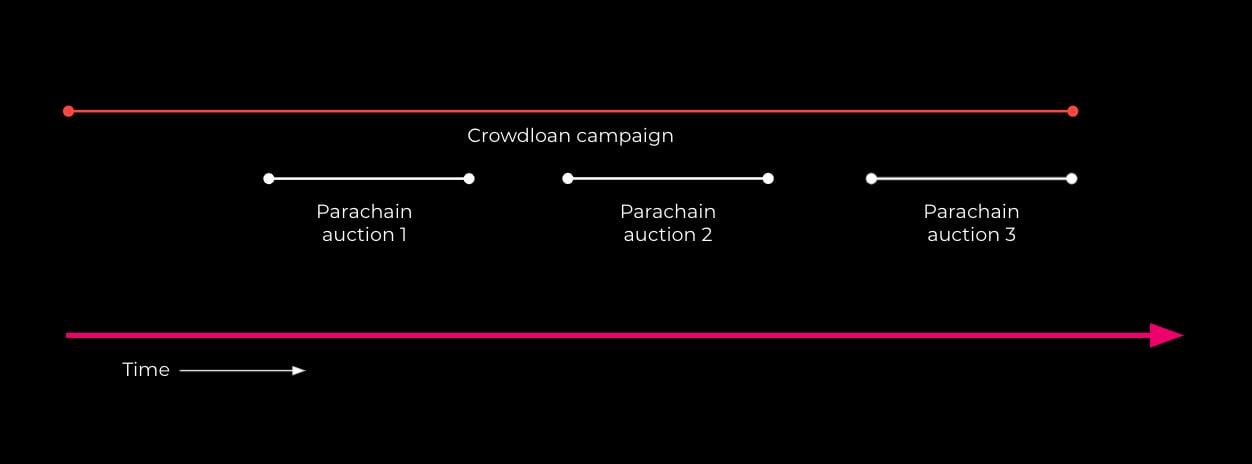

Great question. When you participate in a team's crowdloan, you'll want to check for the duration of their crowdloan campaign. Most teams will choose to have their crowdloan open for longer than just one auction, for example three weeks. Since Kusama auctions are one week, this would cover the team for three auctions. If the team still hasn't won after those three auctions, then all KSM would be returned to you.

The three-week example would look something like this.

DeFi Teller

And as we are nearing the end of our AMA and since we've already figured out that we're waiting for information from the Kusama team on the dates, how much time should pass between winning the slot and launching the platform?

Dan Reecer | Acala & Karura

That will be almost immediate. Just a matter of hours/days.

DeFi Teller

Great! We wish you all the luck! And I can't wait to try out Karura!

Dan Reecer | Acala & Karura

Thanks, I can't wait either! Going to be a lot of fun.

DeFi Teller

And, of course, it would be strange not to mention the difficult situation that has developed in the market over the past five days. So I'll make it my last question, Dan. How are you holding up? How has it affected or will it affect the upcoming auction, crowd loans, and project launch?

Dan Reecer | Acala & Karura

We haven't stopped for a second. We are builders and engineers focused on building a better future - we are long term thinkers and don't worry about short term events. As someone who came into crypto right at the beginning of the 2018 bear market, I'm not really affected by market swings anymore. To me it's just an opportunity to get cheaper Bitcoin, and continue dollar cost averaging. This is a long game, and if you believe in the power of an internet-native financial system, then just hold strong and don't worry about the short term.

DeFi Teller

Thank you so much for your answers, Dan! It was a real pleasure to meet you and chat with you! And I hope everyone got their questions answered.

Dan Reecer | Acala & Karura

Thanks for having me!

You can follow me or ask questions on Twitter.

Follow Karura and Acala. Be sure to follow our newsletter, it’s the best place for the most important updates.

DeFi Teller

Thank you!